Inventory trading

Traditional asset backed finance covers accounts receivable and fixed asset positions, through factoring and leasing respectively. BTI’s inventory purchasing models can be integrated alongside these solutions as they do not require goods to be invoiced to a customer.

Inventory

BTI model

- Asset de-/recognition compliant to IFRS

and US GAAP according to Big 4 a

accounting firms - Long term committed funding that is not

reliant on a customer mix or the CP

market - All costs are computed in the material

price

Receivables

Factoring / Supply chain finance

- Only short term funding available due to uncertain customer mix and insurance

availability - Pressure by regulator to disclose these

arrangements after recent high profile

bankruptcies - Hidden recourse on seller through

eligibility criteria of receivables

Fixed assets

Operating leases

- Will move on balance due to IFRS 16

changes - Leases will now be included in assessments by rating agencies and analysts

Our Solutions

Our solutions cover the full life-cycle of inventories, from raw material and work in progress to finished goods.

It is also possible to create tolling structures, where BTI retains ownership of the material from the purchase of the raw material to the direct sale to the final customer.

Advantages

- Improved metrics under IFRS and GAAP, such as improved leverage, earlier revenue recognition and increased ROCE.

- Purchasing on a committed basis, with tenors up to 5 years available

- Higher safety stocks without increasing working capital

- Reduced purchasing price through bulk buying and consignment and strategic timing of purchases

- Reduced logistics cost through bundling of shipments

- Usage of existing trade finance programs on onward sale

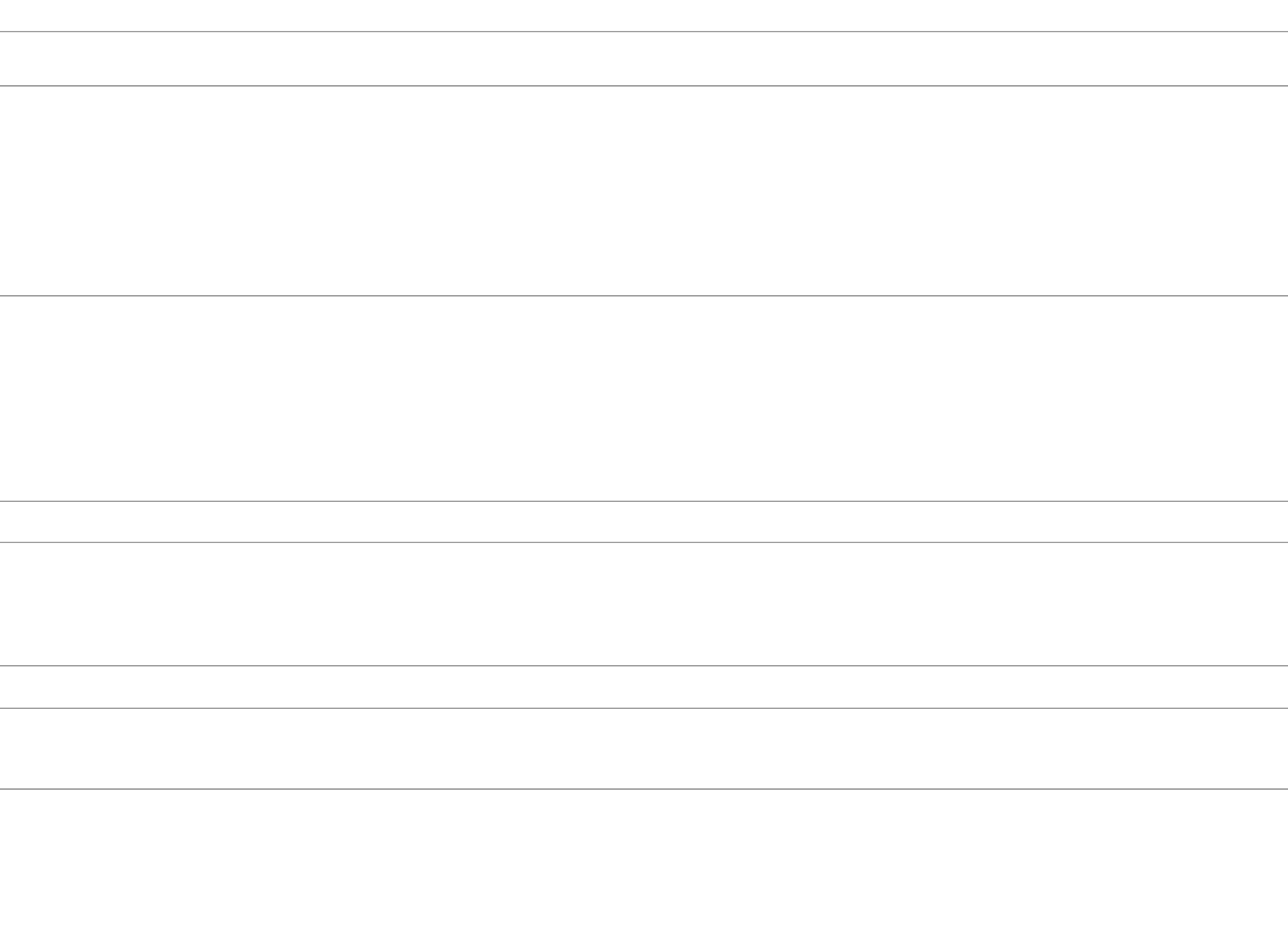

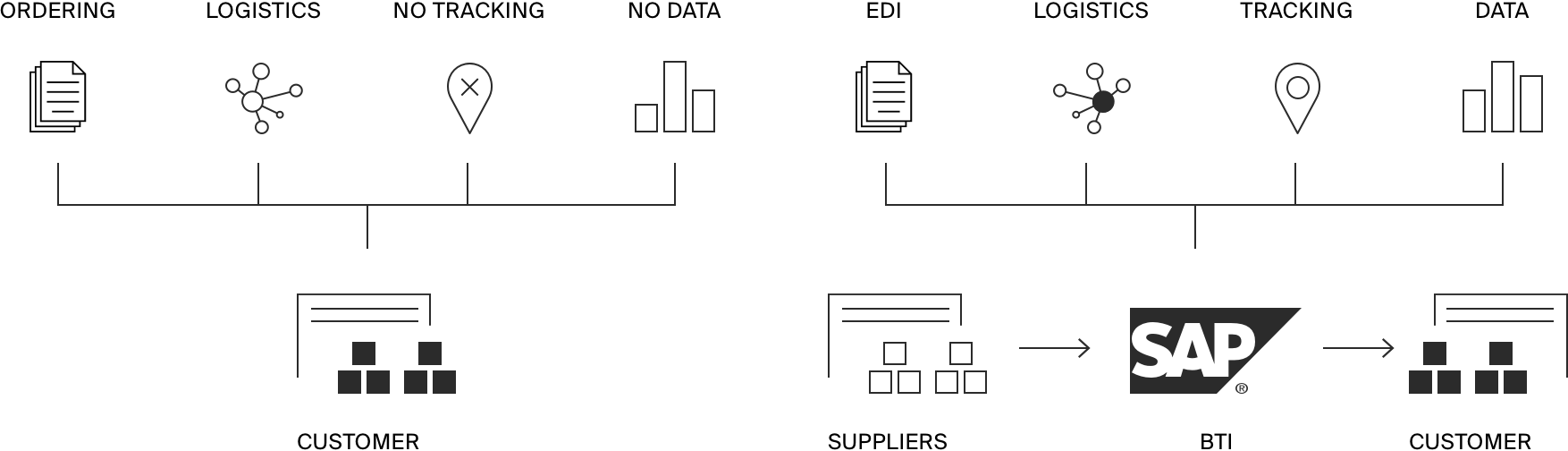

Trade Infrastructure Solution

The backbone of our infrastructure is an SAP S/4 Hana solution that we apply in every supply chain we operate. Once integrated, it serves as a single point of contact for all aspects of the supply chain and can be customized to exchange data directly with a customer’s ERP system.

Flow digitalization

Conversion of EDI orders into paper orders or L/C’s

Digitalization of all logistics nodes and suppliers

Live product location tracking through GPS data

Data interface into BTI system for live inventory levels

Conversion of EDI orders into paper orders or L/C’s

Digitalization of all logistics nodes and suppliers

Live product location tracking through GPS data

Data interface into BTI system for live inventory levels

Supply chain analytics

Lower operational burden for customers through single contract party

Process transparency by providing electronic transport notifications

Information aggregation in customized cockpits

Forecast and order verification to avoid human order errors

Lower operational burden for customers through single contract party

Process transparency by providing electronic transport notifications

Information aggregation in customized cockpits

Forecast and order verification to avoid human order errors